Stacking the Federal Tax Credit with California Deductions

Executive Summary

The intersection of federal civil rights mandates and fiscal policy creates a powerful, albeit often underutilized, financial instrument for business owners. In 2025, this intersection is most potent within the jurisdiction of California. While the Americans with Disabilities Act (ADA) imposes strict accessibility requirements on physical and digital infrastructure, the Internal Revenue Code (IRC) and the California Revenue and Taxation Code (R&TC) provide compensatory mechanisms that, when strategically stacked, can recover a substantial majority of compliance costs.

This report, titled “Double the ROI,” provides an exhaustive technical analysis of the interplay between Federal IRC Section 44 (Disabled Access Credit), Federal IRC Section 190 (Barrier Removal Deduction), and California’s specific conformity provisions updated through Senate Bill 711. It posits that California taxpayers possess a unique arbitrage opportunity: the ability to claim the maximum federal tax credit while simultaneously preserving a nearly full state-level deduction. This “stacking” strategy effectively subsidizes the transition to full accessibility—including expensive website remediation—mitigating litigation risk while significantly reducing effective tax liability.

The following analysis is designed for tax professionals, business owners, and financial officers operating in California. It dissects the legislative history, the mathematical mechanics of the tax arbitrage, the evolving case law regarding digital accessibility in the Ninth Circuit, and the specific compliance requirements for the 2025 tax year.

Part I: The Socio-Legal Context of Accessibility Incentives

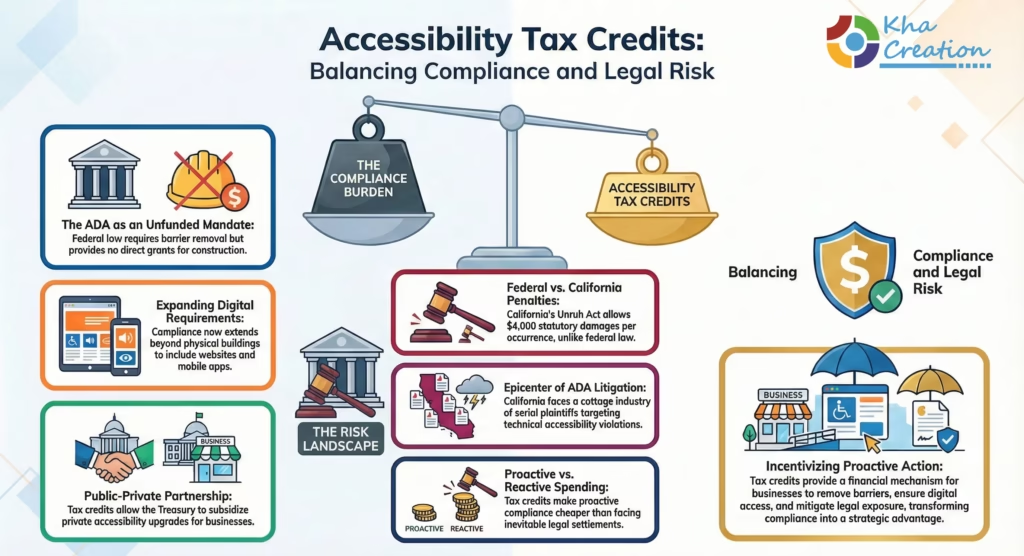

To fully appreciate the financial mechanics of the tax credits in question, one must first understand the legislative intent and the current legal environment that necessitates these expenditures. The tax incentives are not merely fiscal handouts; they are designed as economic offsets to the regulatory burden imposed by the Americans with Disabilities Act of 1990 (ADA).

1.1 The ADA as an Unfunded Mandate

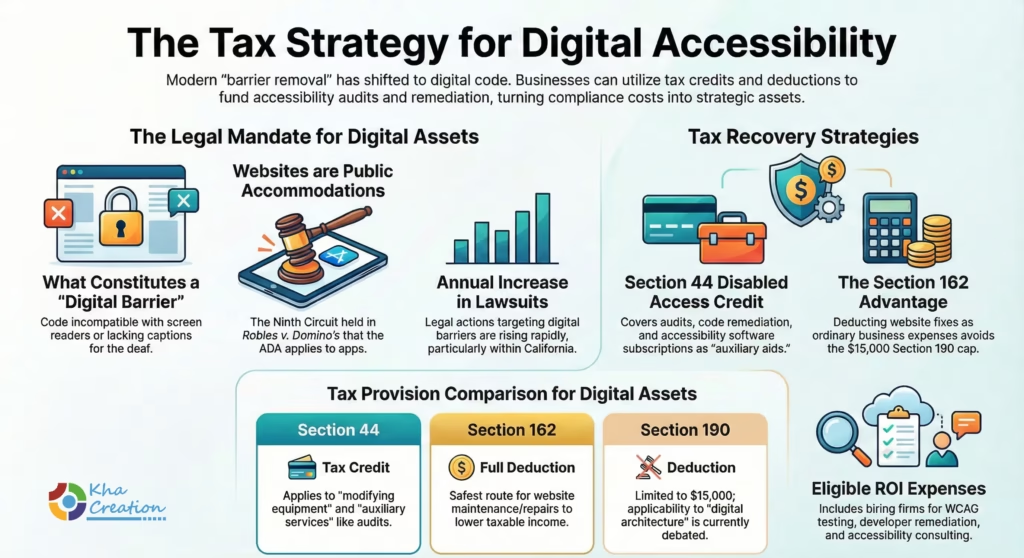

When the ADA was signed into law, it was hailed as a civil rights milestone, prohibiting discrimination against individuals with disabilities in all areas of public life. Title III of the ADA specifically addresses “public accommodations”—private businesses that serve the public, such as restaurants, hotels, theaters, doctors’ offices, retail stores, and increasingly, digital storefronts.1

However, the ADA is often described by economists and policy analysts as an “unfunded mandate.” The federal government requires businesses to remove barriers to access but does not provide direct grants to cover the costs of these renovations. Retrofitting a building to install ramps, widening doorways, or recoding a website to be compatible with screen readers requires significant capital outlay.

Recognizing that this burden would fall disproportionately on small businesses, which lack the capital reserves of major corporations, Congress enacted tax provisions to soften the blow. The legislative logic was simple: rather than direct spending, the government would forgo tax revenue to subsidize private compliance efforts. This creates a public-private partnership where the business owner executes the accessibility upgrades, and the Treasury covers a portion of the cost through tax expenditures.3

1.2 The Litigation Landscape in California

The urgency of leveraging these tax credits is amplified by the litigious environment in California. California is the epicenter of ADA litigation, largely due to the Unruh Civil Rights Act, which essentially “borrows” the ADA standard. A violation of the federal ADA constitutes a violation of the Unruh Act. Crucially, while the federal ADA allows only for injunctive relief (fixing the problem) and attorney’s fees, the Unruh Act allows for statutory damages of $4,000 per occurrence.5

This legal framework has spawned a cottage industry of “serial plaintiffs” and law firms that systematically sue businesses for technical violations. In recent years, this focus has shifted aggressively toward the digital realm. The Ninth Circuit Court of Appeals, which covers California, has held in cases like Robles v. Domino’s Pizza that websites and apps are subject to the ADA.7 Consequently, California businesses face a binary choice: proactively invest in accessibility (physical and digital) or face inevitable settlements that often exceed the cost of compliance.

The tax incentives discussed in this report, therefore, serve a dual purpose: they are a mechanism for capital recovery and a tool for risk management. By subsidizing the cost of compliance, they make the “proactive” choice financially viable.

Part II: The Federal Framework (IRC Sections 44 & 190)

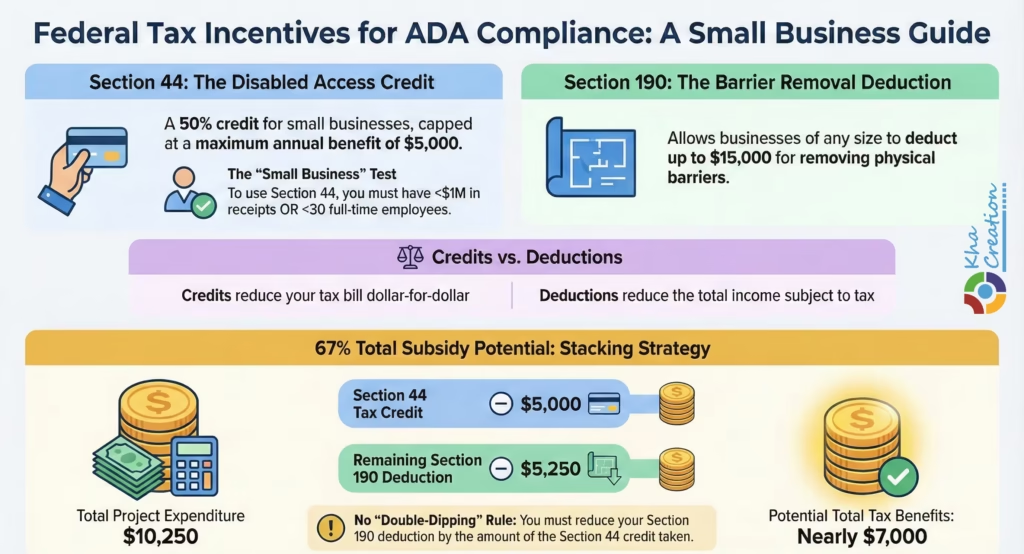

The federal incentive structure is bifurcated into a tax credit (Section 44) and a tax deduction (Section 190). Understanding the nuance of “credit” versus “deduction” is fundamental to the stacking strategy. A deduction lowers the income subject to tax, while a credit reduces the tax itself dollar-for-dollar.

2.1 IRC Section 44: The Disabled Access Credit

The Disabled Access Credit is the crown jewel of federal accessibility incentives. It was specifically engineered to help small businesses that might otherwise claim that ADA compliance constitutes an “undue burden.”

2.1.1 Eligibility: The “Small Business” Definition

For the 2025 tax year, a business qualifies as an “eligible small business” if it meets either of the following criteria based on the preceding tax year (2024) 1:

- Gross Receipts Test: The business had gross receipts of $1,000,000 or less.

- Deep Dive: “Gross receipts” is not just profit. It includes total sales (net of returns and allowances) and all other amounts received for services, investments, and from other sources. For a business on the cusp, accounting methods (cash vs. accrual) in the prior year can determine eligibility for the credit in the current year.

- Controlled Groups: Aggregation rules apply. If multiple businesses are under common control (controlled group), their receipts must be aggregated to test against the $1 million limit. This prevents a large enterprise from splitting into smaller shells to claim the credit.10

- Full-Time Employee Test: The business had 30 or fewer full-time employees.

- Deep Dive: The definition of “full-time” for Section 44 is specific: an employee who works at least 30 hours per week for 20 or more calendar weeks in the tax year.3 This provides significant flexibility. A seasonal business with 50 employees who only work for the summer (12 weeks) would still qualify because none meet the 20-week threshold. Similarly, a business with 40 employees working 25 hours a week would qualify.

Strategic Insight: A business with $10 million in revenue can still qualify if it has only 25 full-time employees (e.g., a high-revenue consultancy or a highly automated tech firm). Conversely, a low-margin restaurant with 50 employees can qualify if its revenue is under $1 million (though unlikely with that headcount). Meeting one test is sufficient.2

2.1.2 Calculation Mechanics

The credit covers 50% of “eligible access expenditures” that fall between $250 and $10,250.

- The Deductible Floor: The first $250 of spending generates no credit. This was likely intended to prevent administrative burden for trivial expenses.

- The Cap: Expenses above $10,250 do not generate additional credit.

- The Math:

- Maximum Eligible Expense: $10,250.

- Minus Floor: ($250).

- Creditable Base: $10,000.

- Credit Rate: 50%.

- Maximum Credit: $5,000.

This credit is non-refundable, meaning it can reduce tax liability to zero but cannot generate a refund check. However, it is part of the General Business Credit (GBC). Unused GBCs can generally be carried back one year and forward 20 years, ensuring the value is rarely lost.10

Get Accessibility Tax Credit Guide

2.1.3 Eligible Expenditures

IRC Section 44(c) defines eligible access expenditures broadly 2:

- Barrier Removal: Removing architectural, communication, physical, or transportation barriers in existing facilities (placed in service before Nov 5, 1990).

- Auxiliary Aids & Services:

- Qualified interpreters for the hearing impaired.

- Qualified readers, taped texts, or Braille materials for the visually impaired.

- Acquisition or modification of equipment or devices for individuals with disabilities.

Critical Distinction: The “placed in service before 1990” rule applies primarily to architectural barrier removal. It does not apply to the provision of auxiliary aids, services, or equipment modifications.14 This is vital for digital accessibility. A business founded in 2020 can still claim the credit for website remediation (an auxiliary aid/service) even if its building is new construction and thus ineligible for architectural credits.

2.2 IRC Section 190: The Barrier Removal Deduction

While Section 44 is limited to small businesses, Section 190 is available to businesses of any size. It addresses a fundamental tax disadvantage regarding renovations.

2.2.1 The Capitalization Problem

Under standard tax rules (IRC Section 263), improvements to property that increase its value or extend its life must be capitalized. This means the cost is not deducted immediately but is depreciated over the asset’s recovery period (e.g., 39 years for commercial real estate). A $15,000 ramp, if capitalized, might yield a deduction of only ~$385 per year.

2.2.2 The Section 190 Solution

Section 190 allows taxpayers to elect to treat qualified architectural and transportation barrier removal expenses as current expenses—deductible in full in the year paid or incurred.3

- Annual Limit: The deduction is capped at $15,000 per tax year.

- Excess: Any amount over $15,000 must be capitalized and depreciated under normal MACRS rules.9

- Qualifying Standards: The removal must arguably meet the standards set forth in the ADA Accessibility Guidelines (ADAAG). The 2010 Standards are the current benchmark. The regulations specifically note that the deduction is for “barrier removal,” implying the structure must be an existing facility.18

2.2.3 Safe Harbors

The IRS provides a safe harbor for “routine maintenance,” but barrier removal is distinct. However, if an element complies with the 1991 Standards (Safe Harbor), a business is not required to upgrade it. If they choose to upgrade it anyway to improve access, Section 190 applies.18

2.3 The Federal Interaction: Basis Reduction

The tax code prevents “double-dipping”—claiming two benefits for the exact same dollar. IRC Section 44(d)(7) explicitly states that no deduction shall be allowed for the amount of the credit allowed under Section 44.3

When a business uses both incentives, it must reduce the basis of the expenditure eligible for Section 190 by the amount of the Section 44 credit taken.

Example of Federal Interaction:

- Expenditure: $10,250.

- Credit Calculation: ($10,250 – $250) * 50% = $5,000 Credit.

- Deduction Basis Adjustment: $10,250 (Total) – $5,000 (Credit) = $5,250 Deductible.

On the federal return, the taxpayer gets a $5,000 tax reduction (worth $5,000) and a $5,250 income reduction (worth ~$1,942 at a 37% rate). The total federal benefit is ~$6,942 on a $10,250 spend—a 67% subsidy.

Part III: The California Tax Matrix (2025)

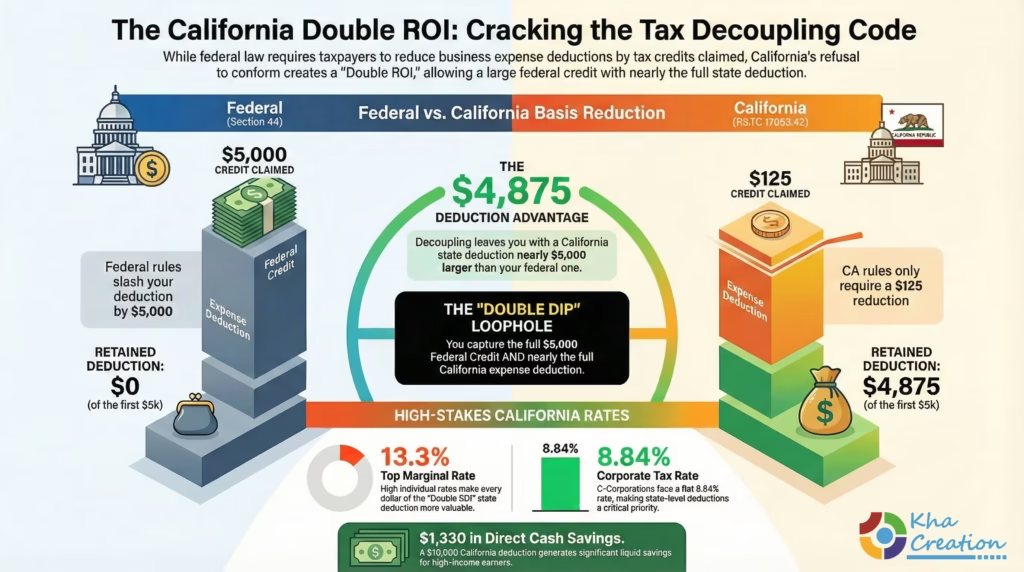

The “Double ROI” strategy emerges when we overlay California’s tax code onto this federal framework. California is a “conformity” state, meaning it generally adopts the Internal Revenue Code as a baseline but makes specific modifications (decoupling) where it sees fit.

3.1 California Tax Rates: The High Stakes

To understand the value of a California deduction, one must appreciate the severity of California’s tax rates.

- Corporate Rate: C Corporations pay a flat 8.84% tax on net income.21

- Financial Institutions: Banks pay 10.84%.21

- S Corporations: Unlike federal law where S-Corps pay zero entity-level tax, California imposes a 1.5% tax on S-Corp net income (minimum $800).21

- Individual Rates (Pass-Through): For LLC members, partners, and S-Corp shareholders, income flows through to their personal returns. California has the highest marginal income tax rate in the country.

- Top Bracket (Single >$681k, Married >$1.36M): 12.3%.

- Mental Health Services Act (MHSA) Surcharge: An additional 1% on income over $1 million.

- Total Top Rate: 13.3%.22

A $10,000 deduction in California is worth up to $1,330 in cash savings for a high-income earner, significantly more than in states with low or no income tax.

3.2 Senate Bill 711: The Conformity Update

In October 2025, California enacted Senate Bill 711, updating the state’s conformity date from January 1, 2015, to January 1, 2025.24 This was a massive legislative shift, aligning California with many federal changes from the previous decade.However, conformity is rarely absolute. California notoriously “decouples” from federal tax credits. While SB 711 adopted many administrative definitions, it did not adopt the federal Section 44 Disabled Access Credit amount. Instead, California retained its own, pre-existing credit structure for disabled access.

Get Accessibility Tax Credit Guide

3.3 The California Disabled Access Credit (R&TC 17053.42)

California offers its own version of the Disabled Access Credit, but it is chemically diluted compared to the federal version.

- Calculation: 50% of eligible access expenditures.

- Cap: The credit only applies to expenditures up to $250.

- Maximum Credit: $125 ($250 * 50%).12

At first glance, a $125 credit seems trivial, almost insulting compared to the $5,000 federal credit. However, for the tax strategist, this tiny credit is the key to the castle. It establishes that California has its own credit regime, independent of the federal credit amount.

3.4 The Conformity Loophole (Basis Reduction)

This is the crux of the “Double ROI” strategy.

- Federal Rule: You must reduce your Section 190 deduction by the amount of the Federal Section 44 credit claimed ($5,000).

- California Rule: You must reduce your state deduction by the amount of the credit claimed.12

Crucial Question: Which credit? Because California does not conform to the Federal Section 44 credit amount (it has its own statute R&TC 17053.42), the “credit claimed” for California tax purposes is the California credit ($125), not the federal credit ($5,000).12

Therefore, when calculating the deduction for the California tax return:

- You do not reduce the basis by $5,000.

- You only reduce the basis by $125.

- You are left with a California deduction that is $4,875 larger than your federal deduction.

This decoupling allows you to “double dip” in a way federal law prohibits: you get the massive Federal credit ($5,000) AND a massive California deduction (nearly the full amount).

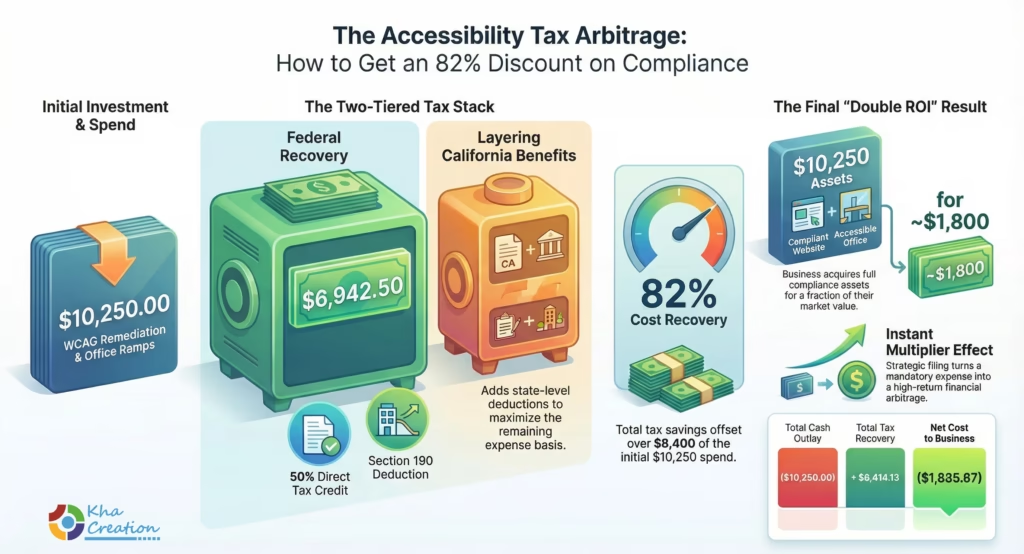

Part IV: The “Double ROI” Calculation (The Math)

Let us quantify this arbitrage with precision using a hypothetical scenario for the 2025 tax year.

Scenario:

- Entity: “TechAccess LLC,” a California marketing agency.

- Owner: Sole Proprietor (Single Filer) in the top tax brackets.

- 2024 Gross Receipts: $850,000 (Qualifies as Small Business).

- 2025 Accessibility Spend: $10,250 (Website WCAG remediation + Office Ramp).

- Federal Tax Rate: 37%.

- California Tax Rate: 13.3%.

4.1 Step 1: Federal Return Calculation

On the federal return, the priority is the tax credit.

- Calculate Federal Credit (Form 8826):

- Expense: $10,250

- Minus Floor: ($250)

- Eligible Amount: $10,000

- x 50% Rate

- Federal Tax Credit = $5,000

- Cash Value: $5,000 (Direct reduction of tax bill).

- Calculate Federal Deduction (Section 190):

- Total Expense: $10,250

- Less Federal Credit Used: ($5,000)

- Remaining Basis: $5,250

- Federal Tax Deduction = $5,250

- Cash Value: $5,250 * 37% Tax Rate = $1,942.50.

Total Federal Benefit: $5,000 + $1,942.50 = $6,942.50.

4.2 Step 2: California Return Calculation

On the California return, the priority is the deduction, as the state credit is negligible.

- Calculate California Credit (Form 3548):

- Expense: $10,250

- Eligible Cap: $250 (State limit)

- x 50% Rate

- California Tax Credit = $125

- Cash Value: $125.

- Calculate California Deduction (Conformity Adjustment):

- Total Expense: $10,250

- Less State Credit Used: ($125)

- Remaining Basis: $10,125

- California Tax Deduction = $10,125.

- Cash Value: $10,125 * 13.3% Tax Rate = $1,346.63.

Total California Benefit: $125 + $1,346.63 = $1,471.63.

4.3 Step 3: The Combined ROI

| Metric | Amount | Notes |

| Total Cash Outlay | ($10,250.00) | The initial cost of compliance. |

| Federal Tax Savings | + $6,942.50 | Credit + Deduction Value |

| California Tax Savings | + $1,471.63 | Credit + Deduction Value |

| Total Tax Recovery | + $8,414.13 | 82.09% of Cost Recovered |

| Net Cost to Business | ($1,835.87) | Actual out-of-pocket expense. |

4.4 The ROI Multiplier

If the business had only taken the deduction (without the credit strategy), or if California forced federal conformity on the basis reduction, the recovery would be significantly lower.

By stacking, the business essentially buys $10,250 worth of assets (website upgrades, ramps) for ~$1,800.

- Effective Discount: 82% off.

- ROI on Tax Prep Fees: Assuming it costs an extra $500 to file these forms, the return is instant and massive.

Get Accessibility Tax Credit Guide

Part V: Digital Accessibility – The New “Barrier Removal”

The most dynamic area of this tax strategy involves digital assets. Historically, “barrier removal” referred to concrete and steel. Today, it refers to HTML and ARIA tags.

5.1 The Legal Consensus: Websites as Public Accommodations

While the US Supreme Court has not issued a definitive ruling, the Ninth Circuit (controlling California) has been clear. In Robles v. Domino’s Pizza, the court held that the ADA applies to the websites and apps of brick-and-mortar businesses.7

- The Implication: A website that is incompatible with screen readers (used by the blind) or lacks captions (for the deaf) contains “barriers” just as real as a flight of stairs to a wheelchair user.

- The Threat: Lawsuits targeting websites have surged 30% year-over-year in California.6

5.2 Qualifying Digital Expenses for Section 44

The IRS has affirmed in various informal guidances and letter rulings that “auxiliary aids and services” include methods of making visually delivered materials available to the visually impaired.

- Eligible Costs:

- Audits: Hiring a firm to test the site against WCAG 2.1 AA standards.

- Remediation: Paying developers to fix code, add alt-text, and improve keyboard navigation.11

- Software/Widgets: Subscriptions to automated accessibility tools (e.g., accessiBe, UserWay). Note: The efficacy of overlays is debated in the legal community, but the cost is generally considered an eligible tax expenditure.1

- Consulting: Fees for accessibility strategy and training.

5.3 Qualifying Digital Expenses for Section 190 (The Risk Area)

There is a technical debate regarding Section 190 and websites. Section 190 strictly refers to “architectural and transportation barriers.”

- Conservative View: Website code is not architecture. Therefore, digital expenses do not qualify for the Section 190 deduction; they should instead be deducted as Section 162 (Ordinary and Necessary Business Expenses).

- Aggressive View: The website is the “digital facility.”

- The “Double ROI” Impact: Does reclassifying from Section 190 to Section 162 hurt the strategy? No. In fact, it might help. Section 162 expenses are fully deductible without the $15,000 cap of Section 190.

- Strategy: If the website work is maintenance/repair (fixing existing site), deduct under Section 162.

- Strategy: If the website work is a complete rebuild (new asset), it might need to be capitalized (Section 263), but the Section 44 credit still applies to the “modification” portion.

Recommendation: For the California return, deducting website remediation as an ordinary business expense (Section 162) is the safest and most effective route. It avoids the Section 190 definitions while still lowering taxable income. The Section 44 credit remains applicable because its definition includes “acquiring or modifying equipment or devices” and “services,” which is broader than Section 190.16

Part VI: Implementation Guide

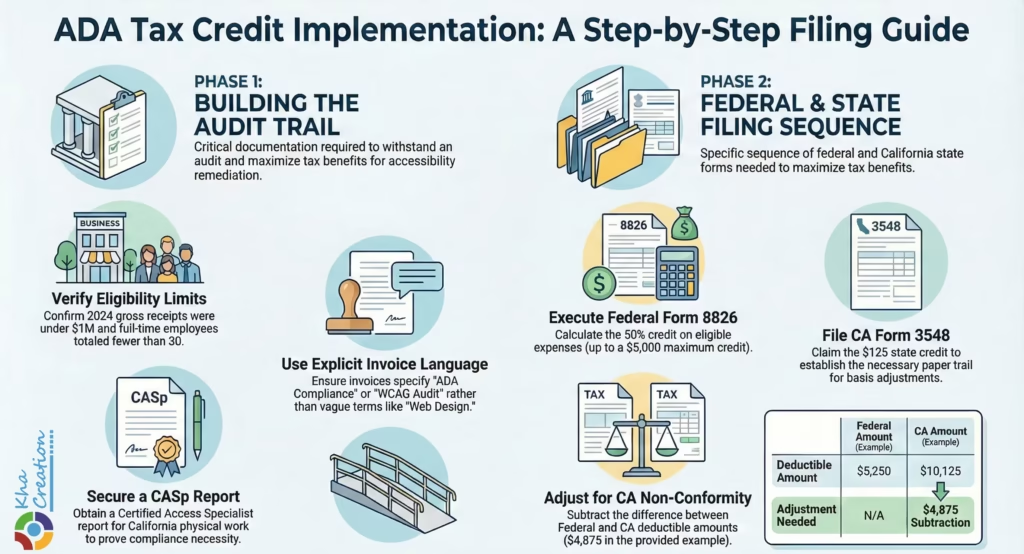

Executing this strategy requires precise coordination between the business owner and the tax preparer. It involves filing specific forms and making manual adjustments to the state return.

6.1 Documentation Requirements

Before filing, ensure the following audit trail exists:

- Prior Year Gross Receipts: Proof that 2024 receipts were <$1M (Tax returns, P&L).

- Full-Time Employee Count: Payroll records verifying <30 FTEs in 2024.

- Invoices: Vendor invoices must explicitly state “ADA Compliance,” “Accessibility Remediation,” or “WCAG Audit.” Vague terms like “Web Design” or “Renovation” invite IRS scrutiny.29

- CASp Report (for Physical Work): In California, a Certified Access Specialist (CASp) report is highly recommended to prove the work was necessary for compliance.30

6.2 Federal Forms

- Form 8826 (Disabled Access Credit):

- Line 1: Enter total eligible expenses (e.g., $10,250).

- Line 2: $10,250 (Limit).

- Line 3: Enter smaller of Line 1 or 2.

- Line 4: Subtract $250.

- Line 5: Multiply by 50%.

- Result: $5,000 Credit.

- Form 3800 (General Business Credit): The value from Form 8826 flows here.10

- Form 4562 (Depreciation/Amortization): If capitalizing any excess.

- Schedule C / Form 1120 / 1120-S: Enter the deduction amount ($5,250) on the “Other Deductions” line, labeled “Section 190 Barrier Removal (Net of Credit)”.

Get Accessibility Tax Credit Guide

6.3 California Forms

- Form 3548 (Disabled Access Credit for Eligible Small Businesses):

- This form mimics the federal form but with the lower caps.

- Calculate the $125 credit.

- Important: Even though the credit is small, filing this form creates the paper trail that you claimed the state credit, which justifies the basis adjustment logic.12

- Schedule CA (540) or Schedule F (Form 100): State Adjustments.

- This is where the magic happens. You must utilize the “Subtractions” column.

- The Adjustment: You are subtracting the difference between the California deductible amount ($10,125) and the Federal deductible amount ($5,250).

- Entry: Enter $4,875 in the Subtractions column for “Other Deductions” or “Business Income.”

- Description: “Adjustment for Section 44/190 Basis Difference – CA Non-Conformity to Fed Credit.”.31

FAQ

Q1: Can I use this strategy every year?

A: Yes. Unlike some credits that are one-time use, IRC Section 44 and Section 190 are annual. If you incur eligible expenses in 2025, 2026, and 2027, you can claim the credit and deduction in each of those years. This is particularly valuable for subscription-based website accessibility solutions or multi-phase building renovations.3

Q2: My business had $1.2M in revenue but only 5 employees. Do I qualify?

A: Yes. The test is disjunctive (OR, not AND). You only need to meet one of the criteria: either <$1M revenue OR <30 full-time employees. Since you have fewer than 30 employees, you qualify regardless of revenue.1

Q3: I operate an LLC. How does the credit pass through?

A: For an LLC taxed as a partnership, the credit is calculated at the entity level but passed through to the partners via Schedule K-1. The partners then claim the credit on their individual returns (Form 1040). The deduction reduces the net income passed through to the partners. Note that the dollar limits ($10,250 cap) apply at both the entity level and the partner level, preventing multiple partners from claiming the full cap on the same expense.12

Q4: Does new construction qualify?

A: Generally, No. The Section 44 credit for architectural barrier removal is limited to facilities placed in service before November 5, 1990. However, expenses for auxiliary aids and services (like website accessibility or sign language interpreters) do not have this age restriction. You can claim the credit for making a brand-new website accessible.14

Q5: Is the “Double ROI” strategy considered a tax shelter?

A: No. It is a statutory application of conformity rules. California explicitly chose not to conform to the federal credit amount. The basis reduction rules in the Revenue and Taxation Code generally track with the credits allowed under that code. Since the federal credit is not allowed under the CA code (only the state credit is), the federal basis reduction does not apply. This is a standard “book-tax difference” or “state-federal difference” managed on Schedule CA.

Q6: Can I claim the credit for consulting fees?

A: Yes. If the consulting is directly related to compliance (e.g., a CASp inspection or a digital accessibility audit), it is an eligible expenditure. General legal fees for defending a lawsuit are not eligible for the credit, though they may be deductible as business expenses.14

Part VIII: Tabular Data and Quick References

Table 1: Side-by-Side Comparison of Incentives (2025)

| Feature | Federal (IRS) | California (FTB) |

| Primary Statute | IRC § 44 (Credit) / § 190 (Deduction) | R&TC § 17053.42 (Credit) / § 17201 (Deduction) |

| Small Business Limit | <$1M Gross Receipts OR <30 FTEs | Same (Conforms to Federal definition) |

| Credit Calculation | 50% of expenses between $250 - $10,250 | 50% of expenses up to $250 |

| Max Credit Amount | $5,000 | $125 |

| Deduction Limit | $15,000 (Section 190) | $15,000 (Conforms to Section 190) |

| Basis Reduction | Reduce deduction by $5,000 (Fed Credit) | Reduce deduction by $125 (State Credit) |

| Carryforward | Back 1 year, Forward 20 years | Forward until exhausted |

Table 2: 2025 Tax Brackets (Projected) for High-Income Earners

Used for calculating ROI.

| Jurisdiction | Filing Status | Income Bracket | Marginal Rate |

| Federal | Single | $250,526 - $626,350 | 35% |

| Federal | Single | $626,350+ | 37% |

| Federal | Corporate | Flat Rate | 21% |

| California | Single | $360,659 - $432,787 | 9.3% |

| California | Single | $432,787 - $721,314 | 10.3% |

| California | Single | $721,314 - $1,000,000 | 11.3% |

| California | Single | $1,000,000+ | 13.3% (Includes 1% MHSA) |

| California | C-Corp | Flat Rate | 8.84% |

Table 3: Audit Risk Factors

Common triggers for scrutiny on these credits.

| Risk Factor | Mitigation Strategy |

| New Construction | Ensure Section 44 credit is claimed only for "auxiliary aids" (digital/equipment), not architectural changes to new buildings. |

| Round Numbers | Avoid claiming exactly $10,250 unless receipts match exactly. Use actual invoice amounts. |

| Generic Invoices | Ensure vendors itemize "Accessibility" services separately from general "Design" or "Hosting." |

| Employee Count | Keep payroll logs to prove FTEs < 30 (defined as 30hrs/wk for 20+ weeks). |

Conclusion

The "Double ROI" strategy represents one of the most efficient uses of the tax code available to California business owners in 2025. By understanding the nuance of Senate Bill 711 and the specific non-conformity of California's Disabled Access Credit, taxpayers can lawfully stack federal and state benefits to recover over 80% of their accessibility expenditures.

This financial subsidy fundamentally alters the business case for ADA compliance. It transforms accessibility from a sunk cost into a subsidized asset enhancement. In an era where digital accessibility lawsuits are accelerating, the ability to secure a website or facility against litigation for roughly 18 cents on the dollar is not just a tax strategy—it is a business survival imperative.

Disclaimer: This report is for educational purposes only. Tax laws are complex and subject to change. Business owners should consult with a qualified CPA or tax attorney to verify eligibility and proper filing procedures for their specific situation.

References/Works cited

- Everything You Need To Know About ADA Tax Credits in 2025 - accessiBe, accessed on January 22, 2026

- Fact Sheet: Disability-Related Tax Provisions | U.S. Equal Employment Opportunity Commission, accessed on January 22, 2026

- Tax benefits for businesses who have employees with disabilities | Internal Revenue Service, accessed on January 22, 2026

- Fact Sheet 4. Tax Incentives for Improving Accessibility - gov.ada.archive, accessed on January 22, 2026

- ADA Compliance for Small Businesses, accessed on January 22, 2026

- SF Barrier Removal Grant & ADA Funding Guide - Kha Creation, accessed on January 22, 2026

- a multiperspective examination of ada title iii serial litigation in new york city's chinatown, accessed on January 22, 2026

- Minh N. Vu | People | Seyfarth Shaw LLP, accessed on January 22, 2026

- Tax benefits for businesses that accommodate people with disabilities - IRS, accessed on January 22, 2026

- About Form 8826, Disabled Access Credit | Internal Revenue Service, accessed on January 22, 2026

- Mitigate the risk of lawsuits by complying with accessibility legislation & understand ADA Tax Credit Information - Schuylkill Chamber of Commerce, accessed on January 22, 2026

- 2022 California Form 3548 Disabled Access Credit for Eligible Small Businesses - Franchise Tax Board, accessed on January 22, 2026

- 26 U.S. Code § 44 - Expenditures to provide access to disabled individuals, accessed on January 22, 2026

- How to Apply for an ADA Tax Credit in 2025 - Virtual Field, accessed on January 22, 2026

- Leverage IRS Section 179, Bonus Depreciation & ADA Tax Incentives in 2025, accessed on January 22, 2026

- IRS ADA Tax Credit for Website Compliance - JET Advertising, accessed on January 22, 2026

- 2022 Publication 535 - IRS, accessed on January 22, 2026

- ADA Frequently Asked Questions Knowledge Base - ADA National Network, accessed on January 22, 2026

- ADA Update: A Primer for Small Business, accessed on January 22, 2026

- 2007 California Revenue and Taxation Code Chapter 2. :: Imposition Of Tax - Justia Law, accessed on January 22, 2026

- Business tax rates | FTB.ca.gov, accessed on January 22, 2026

- California State Taxes: What You'll Pay in 2025, accessed on January 22, 2026

- California state income tax brackets and rates for 2024-2025 - H&R Block, accessed on January 22, 2026

- Bill Analysis, SB 711; Conformity Act of 2025 - Franchise Tax Board, accessed on January 22, 2026

- California: Newly enacted law updates IRC conformity - KPMG International, accessed on January 22, 2026

- California's 2025 IRC conformity update: What California taxpayers need to know, accessed on January 22, 2026

- California - Additions--Basis Adjustments - Income Taxes, Personal - Explanations - CCH AnswerConnect | Wolters Kluwer, accessed on January 22, 2026

- Tax Incentives - The Ability Center, accessed on January 22, 2026

- Understanding the Disabled Access Credit: Form 8826 and eligibility | OnPay, accessed on January 22, 2026

- Disability Access Requirements and Resources NOTICE TO BUSINESS LICENSE APPLICANTS AND COMMERCIAL BUILDING PERMIT APPLICANTS - Cotati, CA, accessed on January 22, 2026

- 2024 FTB Publication 1001 Supplemental Guidelines to California Adjustments - Franchise Tax Board - CA.gov, accessed on January 22, 2026

- California Itemized Deduction Adjustments - TaxSlayer Support, accessed on January 22, 2026

- Supplement CA California Tax Forms Guide 2025 Edition - HowardSoft, accessed on January 22, 2026